As someone who has been involved in buying and selling cafes, including my own, this comes up regularly: “I’m thinking of buying a cafe, what should I look for?” It's a great question to ask. Read on for my top 6 things to consider when shopping for a cafe business

Note: Every business is different, and this information is general in nature. It is based on my personal experience and should not be considered financial advice.

1. Look for something you can grow

To be a good investment, you will need to find a way to make the business more valuable over time.

That means attracting new regulars and growing profits. Sometimes it’s worth going for the ugly duckling. Perhaps the fit out is dated, the coffee is bad and the service is slow. Assuming you have a plan, these are all opportunities.

Just bear in mind the things you can’t change - pick somewhere that has a good location, a solid lease & isn’t about to be built out by developers.

2. Don't start with the asking price

This mistake is way too common, don’t start negotiating based on the price the broker quotes - ‘market value’ means nothing.

What matters is net profit, if a business isn’t making any, then it’s effectively worth nothing to you.

Now, if you’re not familiar with the difference between Gross Profit & Net Profit, then it might help to take a look at the example in our previous article on cafe profitability to give you some context.

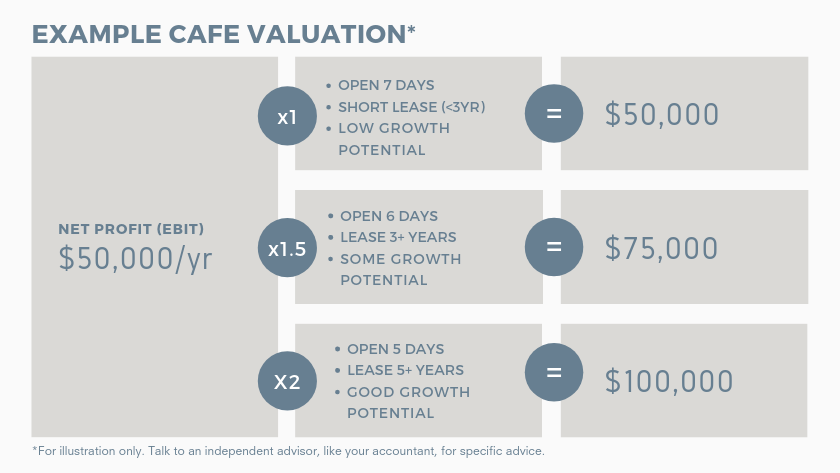

Once that’s out of the way, it’s time to crunch some numbers. The typical way to calculate the value of a cafe business usually goes like this: [Value] = [Net Profit per year] x [a multiplier], which is a number typically somewhere between 1 & 2 The multiplier will likely be on the higher end of the scale if:

- the remaining lease period is long, greater than 5 years (including options) and

- the cafe closes at least one day a week.

Here’s a fictional example of how you might value a cafe based on these factors

Yes, the broker will talk about the value of the equipment, fit out & “goodwill”, but I think better questions to ask are:

- How much profit is the cafe making?

- How can I verify these numbers are accurate?

- How much time is left on the lease to make a return on this investment?

- How much will I need to spend to make the changes needed?

3. The lease is way more important than you think

You really need to understand the details of the lease before making an offer. The future value of the business depends on it, and there’s no guarantee the landlord will offer acceptable terms when the lease ends.

Take a look at how long is left on the term of the lease. This includes any ‘options’ - these offer you the chance to extend the lease when it ends (for example ‘3+3’ means a 3 year lease with a 3 year option). Also, look out for things like: rental increases, demolition/relocation clauses (common in shopping centres) & menu restrictions.

I highly recommend that you talk to a lawyer that specialises in retail leases early in the process.

4. Try before you buy

Cafes are still mostly cash businesses. That makes it hard to know for sure if the owners are being completely honest about their sales & profit figures.

Comparing their BAS statements to the sales figures on the Profit & Loss report can help. After all, people don’t usually give the tax office more than they have to. In the end, often the best way to verify sales figures is to actually spend time working in the business on a trial period. This way, you can check the cash takings at the end of the day as well as observe other issues from behind the counter.

Also, it’s important make sure you clearly understand how the owner is being paid - is their pay coming out as ‘wages’ or are they just taking money out of net profit? It makes a big difference, particularly if you’re not planning to work the same hours they have been working.

5. Start with a plan

Assuming we leave out money laundering, there are two ways to make money from a cafe business:- Run it over the long term (5 years+) and take the operating profits

- Build it up in the short term (2-3 years) and sell it for the capital gain

The approach you take will have an impact on how you approach lease renewals, your business structure (Company, sole trader, trust, etc), tax and more.

Start by putting it all down on paper in your business plan (no, it’s not fun - yes, you need to do it). Then talk it through with your accountant to get some specific strategies in place.

6. Why are you buying a business?

Ok, this should really be the first question. But I thought it might be wise to warm you up before getting personal. Getting into any business should start with ‘Why’. Unfortunately, we regularly see people getting into business for the wrong reasons & with the wrong attitude.

Here’s a collection of the greatest hits:

- “My office job is killing me, I need something less stressful”

- “Making coffee, how hard can it be?”

- “I’ll put in a manager and just keep an eye on things”

- “My kids aren’t motivated to work, so I’m buying them a job”

Here’s the truth: like any business, owning a cafe requires focus, hard work and specific skills - which you will need to acquire if you want to succeed.

It’s not without risk, but for the right person, it can be both satisfying and profitable if you take the time to learn how it’s done.

If you’re also considering opening a café from scratch, take a look at our step-by-step guide. Or checkout our wholesale page for more on how we help local cafe businesses.